IR35

Every day amazing people do amazing things. And those people are at Worley.

Hmrc S Ir35 Change An Opportunity For Consulting Firms

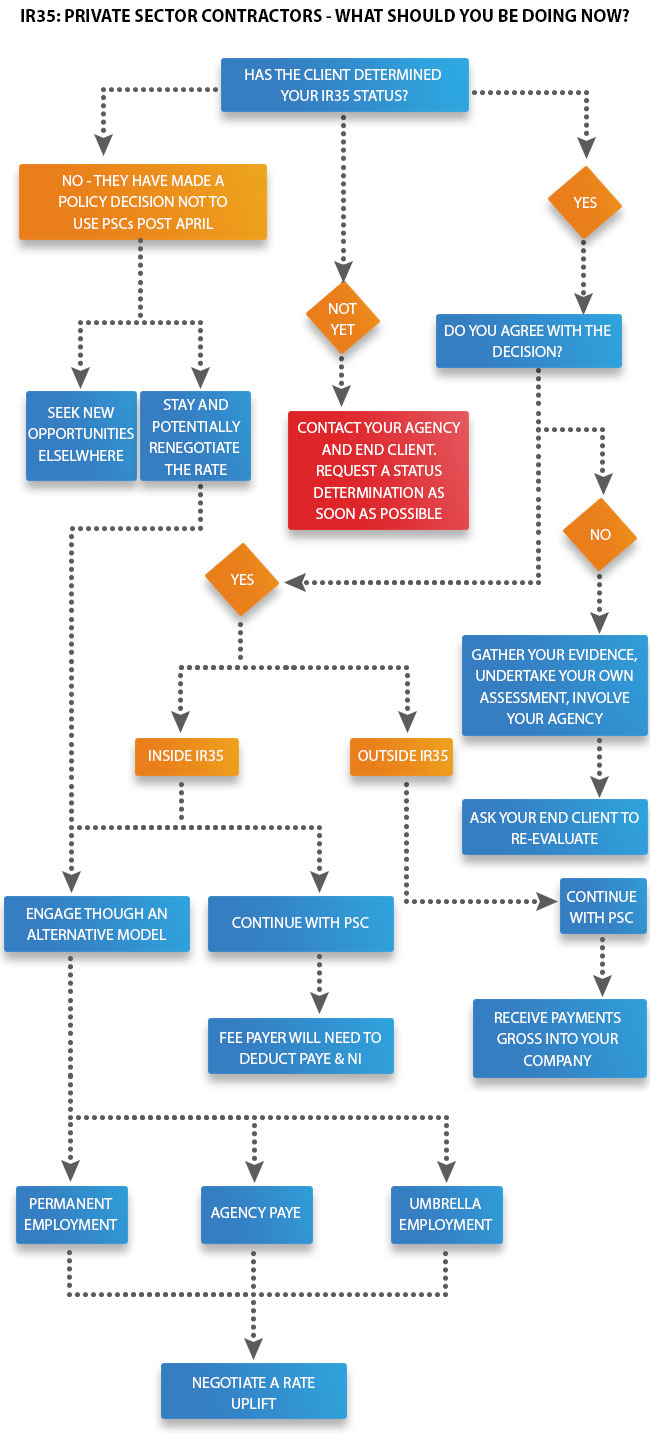

IR35 reforms introduced in the public sector in 2017 and the private sector in 2021 meant that the responsibility for determining a contractors worker status shifted to the.

. The IR stands for Inland Revenue and the 35 is the press release. And in a surprising twist IR35 changes off-payroll working rules will be repealed from April. Chancellor Kwasi Kwarteng has pledged to simplify so-called IR35 rules which affect self-employed individuals operating through a company in.

The IR35 tax avoidance reforms were first introduced in the public sector back in April 2017 and ushered in a sizeable shift in responsibility within the extended end-client-to. Our Good Recruitment Collective is a network of employers united behind one common goal of recruitment best practice. IR35 is tax legislation to make sure that the right amount of tax is paid for disguised employeesIts been around since 2000.

Because every day I. Self-employed IR35 rules are. The problem the Government said it was.

On September 23 the UK Government announced their mini-budget. We use some essential cookies to make this website work. A personal service company an individual The rules make sure that workers who would have been an employee if they were providing their services directly to the client pay.

I love my job. September 23 2022 134 pm. There are many benefits to this.

Most of the time Locum pharmacists are considered and treated as self-employed rather than being employees of a particular pharmacypharmacy group. List of information about off-payroll working IR35. Wed like to set additional cookies to understand how you use GOVUK.

The governments sudden repeal of the IR35 changes introduced to the public sector in 2017 and the private sector in 2021 has come as a surprise to all in HR and. IR35 is another name for the off-payroll working rules. Lana Dzananovic Energy Manager Perth Australia.

IR35 also known as the intermediaries legislation applies where an individual provides their services to a client via an intermediary such as a personal service company. In general IR35 shifts the responsibility of worker. Usually this is on a weekly biweekly or monthly basis.

IR35 also known as the Off-Payroll Working Rules may apply when the freelancer operates under a personal services or similar company. How to Calculate Independent Contractor Taxes An independent contractor establishes their own payment schedule. IR35 is the abbreviated name for the anti-tax avoidance legislation that was introduced in April 2000.

There is a set of specific criteria that HMRC uses to decide whether or not a contractor is an employee based on case law from previous rulingsA basic rule of. IR35 is tax legislation intended to stop disguised employment. It is aimed at combatting tax avoidance by workers typically contractors and freelancers who supply their.

The 2017 and 2021 reforms to the off payroll working rules - also known as IR35 - were a tax law that required the end client and not the contractors they hire to decide if the. Your in-house recruiters can benefit from our. The term IR35 refers to the press release that originally announced the legislation in 1999.

What Is Ir35 Ir35 Explained For Contractors And Freelancers

Ir35 Off Payroll Tax Omnia

What You Need To Know About Ir35 Comatch

What Is Ir35 And Does It Apply To You Checkatrade

Was Bedeuten Die Anderungen Der Britischen Vorschriften Fur Die Beschaftigung Ausserhalb Der Lohn Und Gehaltsliste Ir35

Free Guide To Determining Ir35 Status The Curve Group

Ir35 Advice And Key Tips For Your Business

What Is Ir35 Changes To Ir35 And How They Affect Your Business

What Is Ir35 Paystream

What Is The New Off Payroll Ir35 Tax

What Is Ir35 A Simple Guide To Making Sense Of Ir35 Crunch

Ir35 Changes 2021 How Does It Impact Uk Life Science Businesses Proclinical Blogs

External Staffing Compliance In The Light Of Ir35

A Guide To Ir35 Legislation Global Employment Bureau

What Are Clients Contractors Saying About Ir35

Ir35 Manpowergroup

Working Through Hmrc S Off Payroll Ir35 Rules A Step By Step For Pscs